YouTube Shorts vs TikTok: Where Should You Post Your Short-Form Video?

YouTube Shorts and TikTok are both competing for the same thing: your vertical video attention. But they're not the same platform, and posting the same content to both without understanding the differences is leaving reach, revenue, and subscribers on the table.

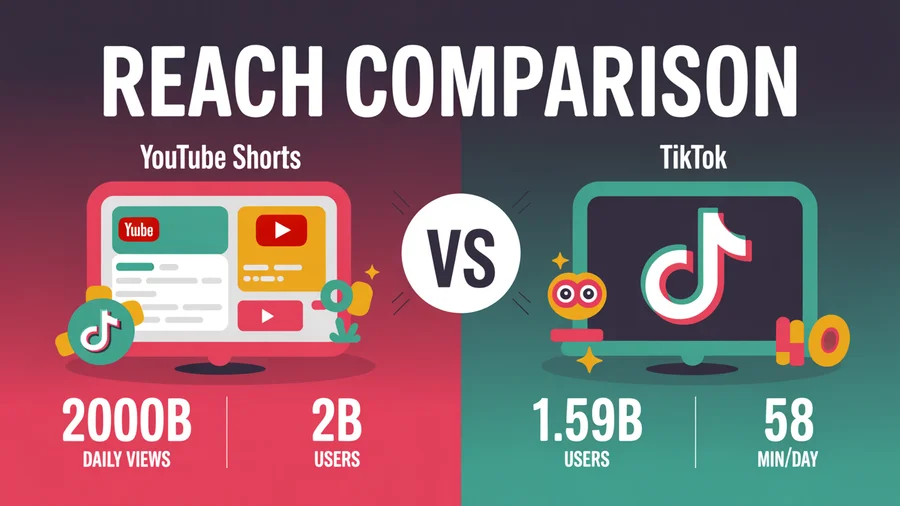

YouTube Shorts now pulls in over 200 billion daily views from 2 billion monthly users. TikTok has 1.59 billion monthly active users spending an average of 58 minutes per day on the app. Both are massive — but they reward different strategies, serve different audiences, and monetize in fundamentally different ways.

This guide compares every dimension that matters so you can decide where to invest your time — or how to use both effectively.

TL;DR

| Factor | YouTube Shorts | TikTok |

|---|---|---|

| Daily views | 200 billion+ | Not publicly disclosed |

| Monthly users | 2 billion | 1.59 billion |

| Best for | Long-term growth, SEO, monetization | Rapid virality, cultural trends, e-commerce |

| Monetization | 45% ad revenue share (YPP) | $0.50–$1.00 per 1K views (Creator Rewards) |

| Content lifespan | Weeks to months | 24–48 hours peak |

| SEO advantage | Indexed by Google Search | Indexed by TikTok search + Google |

| US regulatory risk | None | Ongoing uncertainty |

Table of Contents

- Algorithm: How Each Platform Distributes Content

- Reach and Discovery for New Creators

- Monetization Compared

- SEO: Which Platform Has Better Search Visibility?

- Audience Demographics

- Content Specs and Format Differences

- Best Content Types for Each Platform

- Cross-Posting: Watermarks and Penalties

- Which Is Better for Brands, Creators, and E-commerce?

- 2026 Trends for Each Platform

- What About Instagram Reels?

- FAQs

Algorithm: How Each Platform Distributes Content

YouTube Shorts algorithm

YouTube Shorts runs an explore-exploit loop that evaluates each Short independently. When you upload, it's tested with a small audience. If those viewers watch instead of swiping away, the algorithm pushes it wider.

The three core signals:

- Swipe-away rate — the percentage who leave without watching. Lower is better.

- Watch time relative to length — a 30-second Short with 95% completion beats a 60-second Short with 40%.

- Engagement — likes, comments, shares, and subscribes after watching.

Key behavior: Shorts and long-form content are evaluated by separate recommendation systems. A poorly performing Short won't hurt your long-form content, and vice versa. This makes Shorts a low-risk testing ground.

TikTok algorithm

TikTok's For You Page is powered by an interest graph — it predicts what each user wants to see based on past behavior, not who they follow. The algorithm analyzes:

- Watch time and completion rate — the strongest signal

- Interactions — likes, comments, shares, follows

- Content signals — captions, sounds, hashtags, on-screen text

A key 2026 change: TikTok now shows new videos to existing followers first before distributing to non-followers. This slightly reduces the "instant viral from zero" advantage that made TikTok famous, but the platform still offers more rapid viral potential than any other platform.

The key difference

TikTok optimizes for immediate engagement — most of a video's impact happens in the first 24–48 hours. YouTube Shorts optimizes for sustained performance — a Short can continue getting views for weeks or months through search and recommendations.

Reach and Discovery for New Creators

YouTube Shorts: Better for consistent long-term reach

- 74% of Shorts views come from non-subscribers — Shorts is YouTube's primary discovery format

- Small creators (1–5K followers) average 2,600 views per Short vs. TikTok's 660 views

- Content stays discoverable for weeks or months via search and recommendations

- Shorts that perform well funnel viewers into long-form content (4.5% click-through rate)

TikTok: Better for rapid viral growth

- The algorithm is famously blind to follower count — zero-follower accounts can go viral immediately

- 67% of viral TikTok content comes from accounts with fewer than 10,000 followers

- For You Page surfaces content based on predicted interest, not social connections

- But content lifespan is short: most engagement happens in the first 24–48 hours

Verdict: TikTok is better for overnight virality. YouTube Shorts is better for compound growth that builds over time. Use PostEverywhere's scheduling to post to both platforms at their optimal times.

Monetization Compared

YouTube Shorts: Revenue share model

YouTube pays creators through the YouTube Partner Program (YPP):

- Entry requirements: 500 subscribers + 3M Shorts views in 90 days (limited) or 1,000 subscribers + 10M views (full)

- Revenue split: Creators keep 45% of allocated Shorts ad revenue

- Estimated RPM: $0.01–$0.07 per 1,000 views

- 1 million Shorts views ≈ $10–$70

The real monetization advantage of YouTube isn't Shorts ad revenue — it's the ecosystem. Shorts funnel viewers to long-form content where CPMs reach $5–$20+, and channel memberships, Super Thanks, and affiliate links provide additional revenue streams.

TikTok: Creator Rewards Program

TikTok's Creator Rewards Program (formerly Creator Fund):

- Entry requirements: 10,000 followers + 100,000 views in last 30 days + original content over 1 minute

- Estimated RPM: $0.50–$1.00 per 1,000 qualified views (videos over 1 minute only)

- 1 million views ≈ $500–$1,000 (if videos qualify)

TikTok pays more per view for qualifying content, but the requirement for videos over 1 minute eliminates most short-form clips from the program. TikTok Shop is becoming the bigger monetization play — $15 billion in US sales in 2025, projected to exceed $20 billion in 2026.

Side-by-side monetization

| Metric | YouTube Shorts | TikTok |

|---|---|---|

| Revenue model | Ad revenue share (45%) | Creator Rewards + TikTok Shop |

| RPM per 1K views | $0.01–$0.07 | $0.50–$1.00 (1-min+ videos only) |

| 1M views earnings | $10–$70 | $500–$1,000 (qualifying only) |

| Indirect monetization | Long-form ads, memberships, merch | TikTok Shop, brand deals, live gifts |

| Best for | Long-term compound revenue | Direct creator payments + commerce |

Schedule your monetized content to both platforms from one calendar. PostEverywhere handles YouTube Shorts and TikTok scheduling with per-platform customization — starting at $19/month.

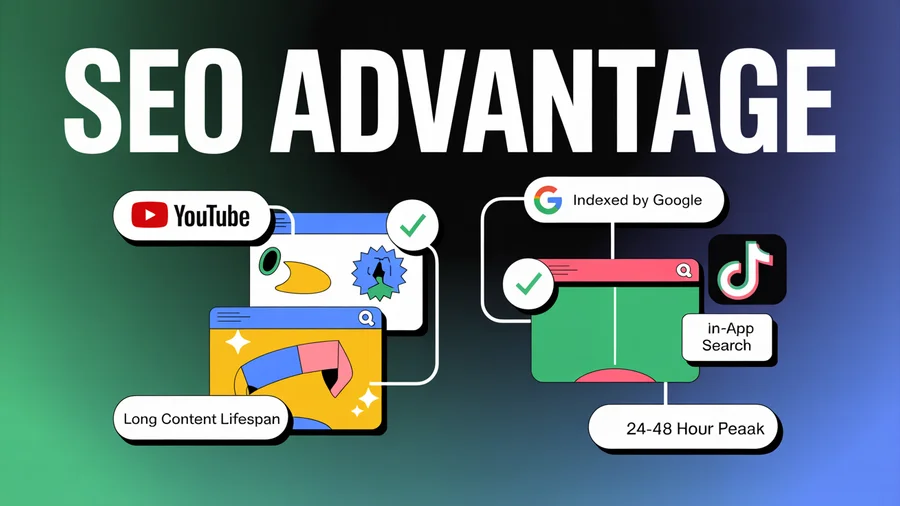

SEO: Which Platform Has Better Search Visibility?

YouTube Shorts: Google integration is the killer advantage

YouTube Shorts appear in Google Search results. TikTok videos don't (or rarely do). This is the single biggest SEO differentiator.

- YouTube is the second-largest search engine in the world (owned by Google)

- 23% of Google Search results display video content — increasingly including Shorts

- YouTube holds 20% citation share across AI platforms (AI Overviews, Perplexity, etc.)

- Shorts content is indexed by YouTube for months or years — true long-tail SEO

- Transcript and caption data is deeply indexed by Google

TikTok: A search engine in its own right

TikTok has become a legitimate search engine, especially for younger users:

- 41% of Americans have used TikTok as a search engine

- 64% of Gen Z use TikTok for search — ahead of Google for certain queries

- TikTok NLP analyzes captions, hashtags, on-screen text, and spoken words

- Keywords in captions boost visibility by 20–40%

- But content lifespan is short — TikTok search results favor recent, trending content

Verdict: YouTube Shorts wins on long-term SEO because of Google integration. TikTok wins on real-time, trend-driven search. If you want content to be discovered 6 months from now, YouTube. If you want to ride a trending query today, TikTok.

Optimize your titles, descriptions, and hashtags for both platforms using our hashtag generator.

Audience Demographics

Both platforms skew younger, but there are meaningful differences.

| Factor | YouTube Shorts | TikTok |

|---|---|---|

| Largest age group | 25–34 (21.5%) | 25–34 (overtook teens) |

| Fastest growing | 35–44 and older | Older millennials |

| Global gender | 54.3% male | 54.5% male |

| US gender | 51.2% female | 61% female |

| Top geography | India, then US | Indonesia, then US |

| Gen Z dominance | Shared with older groups | Stronger Gen Z culture |

| Daily time spent | 28 min (Shorts only) | 58 min (full app) |

TikTok still has a stronger Gen Z cultural identity, but both platforms' largest demographic is now 25–34. YouTube's fastest-growing segment is 35+, which makes Shorts increasingly relevant for brands targeting older millennials and Gen X.

Content Specs and Format Differences

| Spec | YouTube Shorts | TikTok |

|---|---|---|

| Max length | 3 minutes | 10 minutes (in-app); 60 min (upload) |

| Sweet spot | 30–60 seconds | 15–35 seconds |

| Aspect ratio | 9:16 (mandatory) | 9:16 (recommended) |

| Resolution | 1080×1920px | 1080×1920px |

| File format | MP4 (H.264, AAC) | MP4 (Android), MOV (iOS) |

| Music library | YouTube Audio Library | TikTok Sounds (trending audio) |

| In-app editing | Basic | Extensive (effects, green screen, stitch, duet) |

| Captions | Auto-generated or burned-in | Auto-generated via NLP |

The biggest content difference: trending audio is a core distribution mechanism on TikTok. Using viral sounds significantly boosts algorithmic reach. YouTube Shorts doesn't have an equivalent trending audio culture — hooks, visuals, and watch time drive distribution instead.

Best Content Types for Each Platform

YouTube Shorts top performers

- Entertainment and viral reactions

- Before/after transformation reveals

- Life hacks and quick tutorials (15–60 seconds)

- Satisfying process videos

- Tech and smartphone content

- Finance tips (highest CPM)

- Educational/fact-based content (strongest evergreen potential)

TikTok top performers

- Trending audio and dance challenges

- Lo-fi, authentic, unpolished content (the "quiet flex" aesthetic dominates 2026)

- POV format videos

- Companion content ("study with me," "get ready with me")

- Short how-to tutorials solving specific pain points

- TikTok Shop product demos

- Beauty, skincare, and wellness content

The key difference: YouTube Shorts rewards information and value. TikTok rewards entertainment and authenticity. Polished, educational content thrives on Shorts. Raw, personality-driven content thrives on TikTok.

Use our AI content generator to create platform-specific scripts and captions for both platforms. Find optimal tags with the hashtag generator.

Cross-Posting: Watermarks and Penalties

You can post the same video to both platforms, but do it wrong and you'll get penalized.

Rules for cross-posting

Remove all platform watermarks before cross-posting. TikTok-watermarked videos are deprioritized by YouTube and won't qualify for revenue sharing. YouTube-watermarked videos perform worse on TikTok.

Customize captions and hashtags for each platform. Identical captions can trigger duplicate content detection.

Adjust for platform norms. Add trending audio for TikTok; add keyword-rich titles for Shorts. Native content consistently outperforms cross-posted content on both platforms.

Stagger posting times. Don't publish to both platforms at the same second. Give each version its own launch window.

Export clean files. Always download the original, unwatermarked version of your video and upload it separately to each platform.

PostEverywhere's cross-posting feature handles platform-specific customization from one composer — so you get the efficiency of cross-posting with native optimization.

Post to YouTube and TikTok from one dashboard. PostEverywhere lets you customize each platform's version without switching apps.

Which Is Better for Brands, Creators, and E-commerce?

For independent creators

Start on TikTok for fast audience growth from zero. TikTok's interest graph gives unknown creators genuine viral potential. Then build on YouTube Shorts for lasting channel equity, compound subscriber growth, and sustainable monetization through YPP.

For brands

TikTok for top-of-funnel awareness and cultural velocity. The "TikTok made me buy it" phenomenon drives impulse purchases.

YouTube Shorts for authority building, product education, and long-term brand recall. Shorts funnel viewers into longer brand content and are indexed by Google.

For e-commerce

TikTok clearly wins in 2026. TikTok Shop crossed $15 billion in US sales in 2025, with projections exceeding $20 billion in 2026. In-feed shopping with native checkout creates friction-free discovery-to-purchase.

YouTube Shorts is better for considered purchases where education matters — new 2026 features let creators add brand links directly in Shorts.

Rule of thumb: If you want to close a sale in 3 minutes, choose TikTok. If you want to close a sale in 30 days and keep the customer for 3 years, choose YouTube.

For B2B

Neither platform is strongly B2B-native (LinkedIn dominates there). But YouTube Shorts is the better option — thought leadership, tool demos, and case study teasers funnel into long-form content that builds professional trust. Schedule your B2B content with our LinkedIn scheduler alongside your Shorts and manage everything with multi-account management.

2026 Trends for Each Platform

YouTube Shorts trends

- AI creator tools: Make Shorts using your own AI likeness, auto-edit features, AI clip generation from still images

- Shorts-to-long-form bridging: Stronger pathways so Shorts, long-form, and community posts work as an ecosystem

- Image posts: Now integrated into the Shorts feed

- Brand partnership tools: Add brand links in Shorts, swap branded segments when deals end

- Format sweet spot: 50–60 second Shorts achieve a 76% watch-through rate in 2026

TikTok trends

- TikTok Shop dominance: $20B+ projected sales, live commerce going global

- A-Commerce: AI agents streamlining the shopping experience

- Content aesthetic shift: "Quiet flex" — soft, aspirational aesthetics replacing loud viral-bait

- Auto-post from live: Auto-clip high-performing moments from livestreams

- Regulatory uncertainty: US ownership transferred to TikTok USDS LLC (Oracle, Silver Lake, MGX deal) effective January 2026. Platform continues but full deal details remain unclear as of February 2026.

The regulatory factor

TikTok's US regulatory uncertainty is a real strategic risk. The app was briefly dark for US users in January 2025, and the new ownership deal's full terms remain undisclosed. YouTube Shorts carries zero regulatory risk. For US-focused creators and brands, diversifying toward YouTube Shorts is a prudent hedge — even if TikTok continues operating normally.

What About Instagram Reels?

Instagram Reels is the third major short-form video platform, and it's worth a quick comparison:

- 200+ billion daily Reels plays — comparable to Shorts

- Average reach rate of 30.81% — highest of all Instagram formats

- 55% of views from non-followers — solid discovery, but less than Shorts (74%)

- Monetization: Brand partnerships and Shopping integration; no direct ad revenue share equivalent

- Best for: Brands already on Instagram, lifestyle/fashion/beauty niches, Meta's advertising ecosystem

Reels is more integrated with your social graph (friends see your content), which makes it powerful for brands with existing Instagram communities but weaker for pure discovery from scratch.

Schedule Reels alongside your Shorts and TikToks with PostEverywhere's Instagram scheduler. Maintain your Instagram aesthetic across all formats and track results with the engagement rate calculator.

FAQs

Should I post to both YouTube Shorts and TikTok?

Yes — the expert consensus in 2026 is a dual-platform strategy. Use TikTok for cultural velocity, trending moments, and social commerce. Use YouTube Shorts for compound growth, SEO, and long-term channel equity. Customize content for each platform rather than identical cross-posting. Learn how in our content repurposing guide.

Which platform pays more per view?

TikTok pays more per qualified view ($0.50–$1.00 per 1K) through the Creator Rewards Program, but only for videos over 1 minute. YouTube Shorts pays less per view ($0.01–$0.07 per 1K) but has no minimum video length and offers a more reliable revenue share model through YPP.

Can I post the same video to both platforms?

Yes, but remove platform watermarks, customize captions and hashtags for each platform, and stagger posting times. Native content outperforms cross-posted content on both platforms.

Which platform is better for growing from zero?

TikTok gives new creators more rapid viral potential — 67% of viral content comes from accounts under 10K followers. YouTube Shorts offers more consistent reach for small creators (averaging 2,600 views vs. TikTok's 660 for 1–5K follower accounts) but slower initial growth.

Will TikTok get banned in the US?

TikTok's US ownership was transferred to a joint venture (Oracle, Silver Lake, MGX) effective January 2026. The platform continues operating, but full deal details remain unclear. There's no imminent ban, but the regulatory uncertainty makes YouTube Shorts a safer long-term investment for US-focused strategies.

Which platform is better for SEO?

YouTube Shorts — by a significant margin. Shorts appear in Google Search results, YouTube search, and AI platform citations. TikTok has strong in-app search (especially for Gen Z), but TikTok videos rarely appear in Google results. For long-term search visibility, YouTube wins.

How do I decide where to focus if I can only choose one?

If you're a creator building a personal brand or channel, choose YouTube Shorts — the compound growth, SEO, and monetization ecosystem make it the better long-term investment. If you're an e-commerce brand or focused on Gen Z, choose TikTok for its superior shopping integration and cultural relevance. When in doubt, start with TikTok for fast audience building, then expand to YouTube.

Can I schedule posts to both platforms from one tool?

Yes — PostEverywhere lets you schedule YouTube Shorts and TikTok posts from one dashboard with per-platform customization. Plan everything in the content calendar and use best-time scheduling to hit optimal windows on each platform.

The Bottom Line

YouTube Shorts and TikTok serve different strategic purposes. TikTok is the faster path to attention — viral potential, cultural trends, and frictionless e-commerce. YouTube Shorts is the compounding investment — Google SEO, sustained discovery, and a full channel ecosystem that monetizes long-term.

The best strategy in 2026 uses both. Create content in your niche, adapt it for each platform's norms, and schedule everything from one calendar. Use PostEverywhere to manage both platforms alongside Instagram, LinkedIn, Facebook, and X — without switching apps. Check our engagement rate benchmarks to track performance and find how often to post on each platform.

Jamie Partridge

Founder & CEO of PostEverywhere

Jamie Partridge is the Founder & CEO of PostEverywhere. He writes about social media strategy, publishing workflows, and analytics that help brands grow faster with less effort.